Robbinshood: Prince of Thieves

Aaaand we’re back! After taking a three-month hiatus, both this newsletter and my podcast have returned. Check out the latest episode with the inimitable trader-turned-writer, Jared Dillian. In the meantime, let’s slay some dragons…

WHAT’S NEW

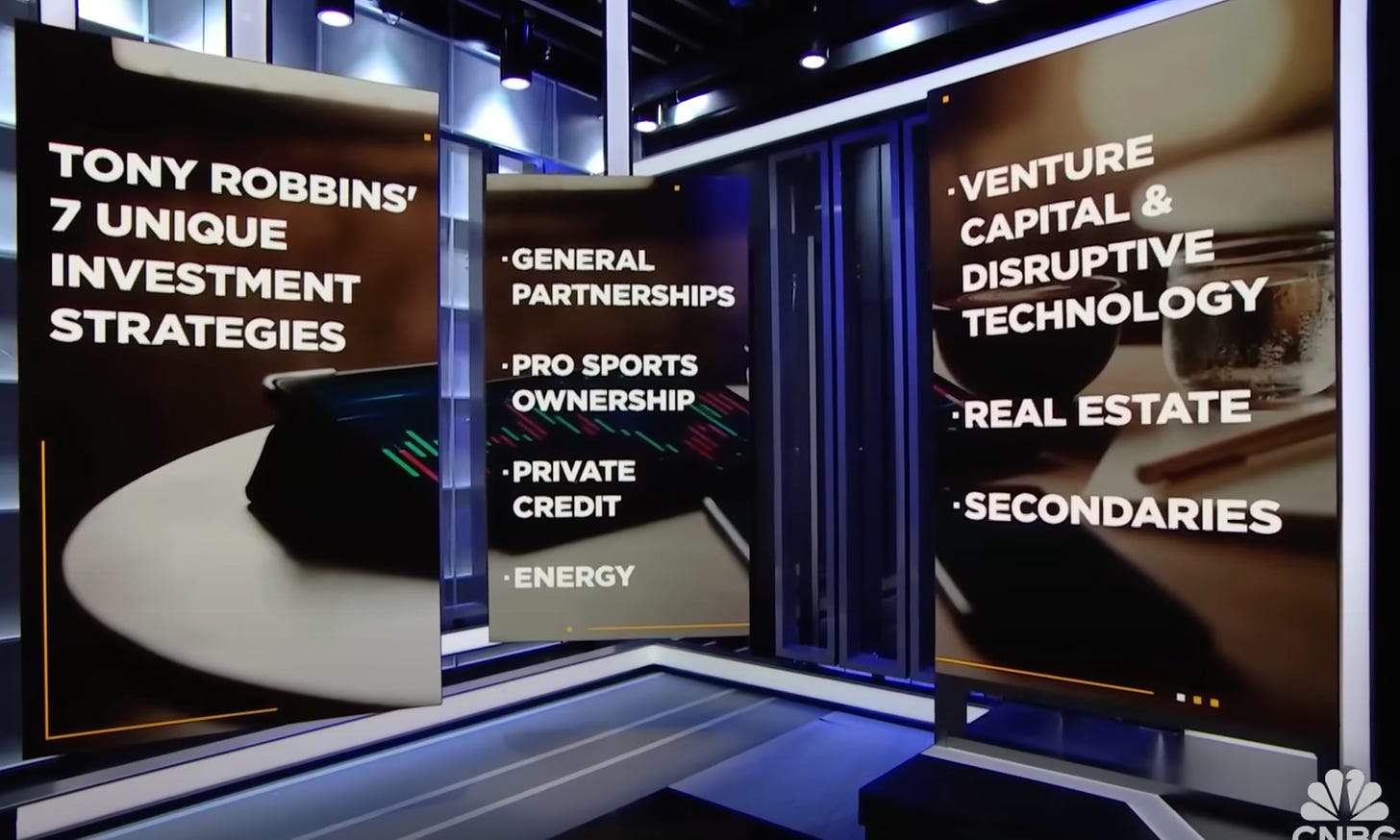

Last month, Tony Robbins released a brochure book called The Holy Grail of Investing, the final installment of his gargantuan1 Financial Freedom trilogy. In it, Big Ton’ implores people to shift their portfolio allocations into alternative investments, the (alleged) best-performing asset class of the last decade-plus. Hmm…

Is this a valid claim or a market-topping grift? A bad case of survivorship bias or a good case of foresight? To find out, I decided to go on my own crusade and read the damn thing, very quickly2 realizing that this book — like the elusive relic it’s named after — will not lead readers to enlightenment (gasp!).

Still, I wanted to be fair to Tony, whose relentless optimism and larger-than-life persona have helped millions. In a world that’s often too cynical, there's something to be said for that. But take a moment and shield your eyes from his Herman Munster charm, and you’ll see this book for what is: two parts promotional tool for the already-rich and one part motivational tool for the wannabe-rich. Less a how-to and more a where-to,3 emphasizing inspiration over implementation and enthusiasm over expertise.

But while Tony is way off regarding his conclusion, he is directionally correct: A holy grail of investing can be aspired to (even for those of us that don’t have Paul Tudor Jones on speed dial). But it probably doesn’t involve owning a smorgasbord of privately-held investments, ranging from the ephemeral (e.g., “energy”) to the laughable (e.g., “pro sports ownership”).4 In the frenzied casino of investing, where fortunes can be made — and lost — on the spin of capitalism’s roulette wheel, success is not about chasing the “outsized returns” of a trendy asset class. And it’s definitely not about following the “smart money.”

Ultimately, investing is about your unique circumstances. Every portfolio should be highly-personalized, hyper-customized, and designed to sustain and nurture over the long term. It should be diversified, not concentrated; low-cost, not high-fee; boring, not sexy. And maybe most of all, it should be behaviorally robust, allowing you — the investor — to hold strong during the market’s (and life’s) ups and downs.

So if you’re searching for the true holy grail of investing, craft a portfolio that reflects who you are and where you want to go. Turn the quest for financial miracles into a journey of personal fulfillment. And, until you know exactly what you’re doing, stay the hell away from privates.

This newsletter is sponsored by

Where wealth meets wisdom. Where plans turn into action. Where your financial future isn't just secure, it's empowered.

MONEY READS

👉🏼 Is private equity actually worth it? by Robin Wigglesworth

“A lot of investors in private equity prefer to justify their large and growing allocations with a reference to a mythical creature called the illiquidity premium, a fairy that apparently sprinkles private markets with its magical return-enhancing dust.”

👉🏼 A Few Thoughts on Spending Money by Morgan Housel

“There’s a difference between nice stuff and fancy stuff. One provides tangible utility, the other offers social utility... Using money to buy nice stuff is great. Fancy stuff is a different, more complicated, animal.”

👉🏼 What Are We Assuming? by Jack Raines

“Don’t get me wrong, I’m bullish on America, and my money is invested accordingly. But it’s important to know which assumptions underpin the stories that we tell ourselves about our money.”

RECOMMENDATIONS

🎧 PODCAST: The History of Curb Your Enthusiasm

In celebration of the show’s final season, Jeff and Susie recap every single episode of this television masterpiece, revealing long-hidden facts and hilarious anecdotes along the way. An absolute must-listen for any true Curb fan.

📖 BOOK: The Mirage Factory: Illusion, Imagination, and the Invention of Los Angeles

Lord knows I love good origin story, and Gary Krist does an exceptional job showcasing Los Angeles’ early-20th-century transformation from frontier town to bustling metropolis, including — of course — the rise of the nascent film industry.

🎥 DOCUMENTARY: The Greatest Night in Pop

Netflix is on fire lately, producing some of the best documentaries I’ve ever seen. But this one — about the recording of We Are The World by Quincy, Lionel, Michael, Stevie, etc.— takes the cake, for no reason other than its mononymous star power.

THE JUKEBOX

Who knew T-Pain had a voice like that!? Between the intimate setting and the ridiculous rendition of War Pigs, this video is one hour of pure gold.

MY LIFE

Here’s an interview I did for a news website catering to local techies and entrepreneurs:

1. How did you come to do this work, and why is it so important to you personally?

I've always been a Finance Guy and spent most of my career in the institutional/corporate space, which wasn't providing enough fulfillment. Then I realized I could leverage my skill set to impact peoples' lives in a positive way - by providing honest, valuable financial advice. I was all-in, but couldn't find an existing firm that was aligned philosophically. So I built one. From scratch.

3. What is the elevator pitch for Adda Financial?

Money is a mindset, a feeling, an emotion. The spreadsheets are important, but secondary to the psychology. Forget about maximizing risk-adjusted returns on your retirement portfolio. Instead, let's optimize for fulfillment, joy, and peace of mind.

4. Talk through your strategy for building a team around you.

I actually don't have plans to hire employees. As the firm grows, I may bring on a part-time planner, but I will continue to leverage technology (and trusted third-party professionals) to serve my clients as a sole advisor.

5. What has surprised you most about starting your own business?

There have been plenty of surprises from a business/operations perspective, but the most interesting surprise has probably been how open, intense, and vulnerable the client conversations have been. I knew we'd have to go deep, but I underestimated the range of emotions that would be expressed, on both sides. It's been a beautiful experience.

6. Talk through one of your daily rituals.

I have three kids now, so it feels like every day is its own adventure. Throw a nascent business into the mix and some days can be sheer chaos. Still, each day I try to eat well, exercise, make at least one connection or impact, and focus on getting 1% better.

7. What is a recent challenge you've faced as an entrepreneur and how did you overcome it? What lesson(s) did you take away from it?

It's been a big challenge juggling three kids (my third was born in October 2023) and a growing business. Luckily, I have an amazing wife, but nothing these days is easy - nothing. Lessons I've learned so far?: Communicate with your spouse, take it day by day, and soak it all in!

8. What does the next year look like for Adda Financial?

I will continue to steadily grow my practice and help clients master their money. But I also plan on doing the same for people who can't afford professional advice, including and especially teenagers. So I'll be teaming up with various organizations to enhance financial literacy in the community, because I truly believe understanding the basics of personal finance can significantly enhance lives, with ripple effects for generations.

9. What is a key piece of advice you've received that you'd want to share with other founders?

You're never going to be "ready." The stars won't align perfectly. Just start!

10. How can our regional startup community help your efforts?

Just spread the word that there are financial services companies that care - that aren't just trying to bleed you dry - and Adda is one of them.

🤙🏼 Pura vida,

Sent with 💛 from Pittsburgh

Thanks for reading!

If you enjoyed this post, please click the 🤍 below. It’ll help spread the word.

Disclaimer: Nothing in this newsletter should ever be considered investment advice.Total page count across the three books: 1,312 (!)

I made it about 15 mind-numbing pages before giving up.

Robbins’ “co-author” is Christopher Zook, CEO of alternative asset manager CAZ Investments. Excerpt from the disclosure: “Mr. Robbins and Mr. Zook have a financial incentive to promote and direct business to CAZ Investments.”