The Matrix

A helpful framework for investing decisions

Due to my position (and proclivities), people occasionally request my opinion on specific investments — stocks, crypto, real estate, etc. Usually, it’s a friend or client asking some variation of “Should I buy?” or “Should I sell?” After leading with a caveat, where I explain that I have no damn clue where the price of this particular asset will go, I ask a few open-ended questions to get a better handle on their situation. Then we’ll go through an exercise I call The Matrix.

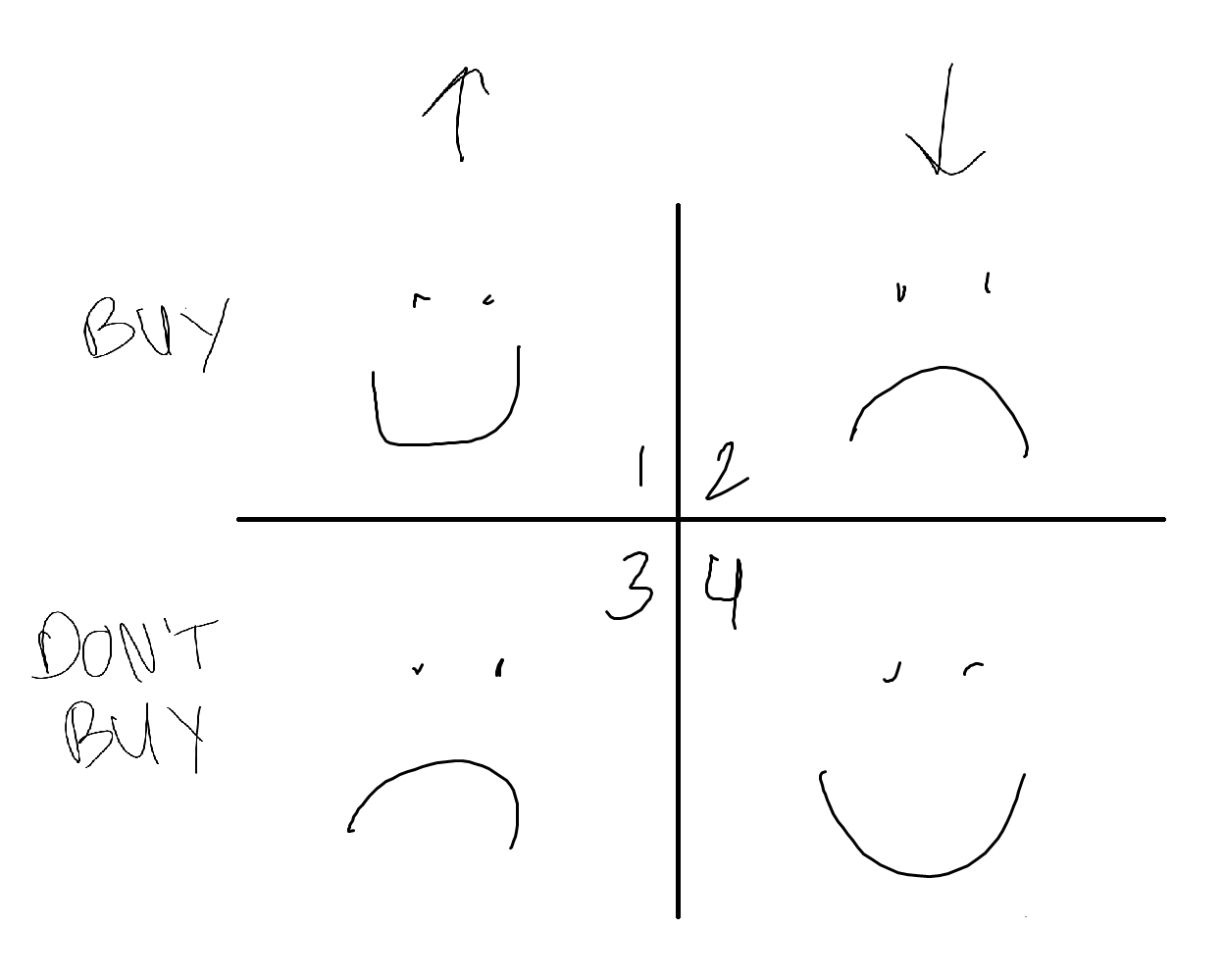

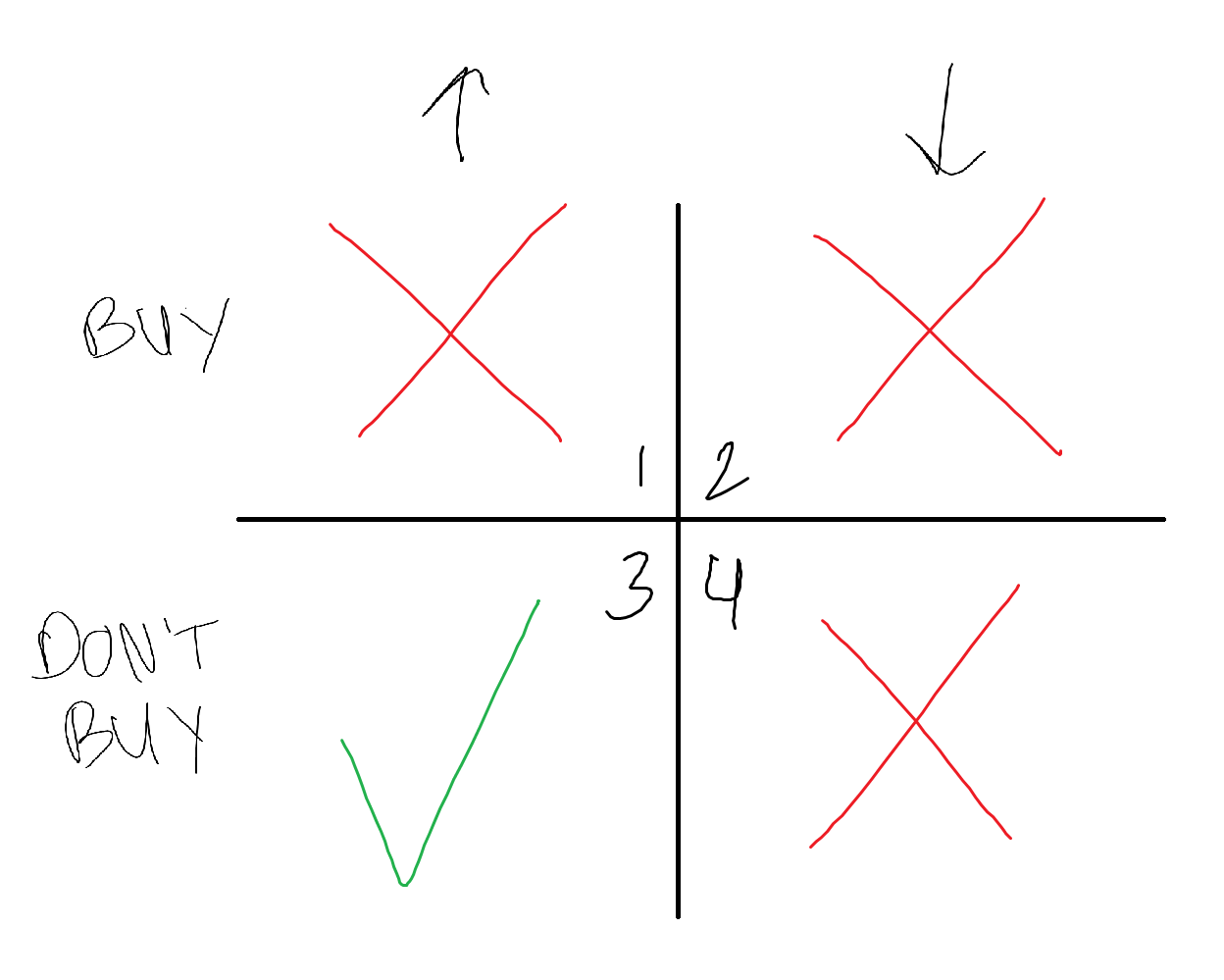

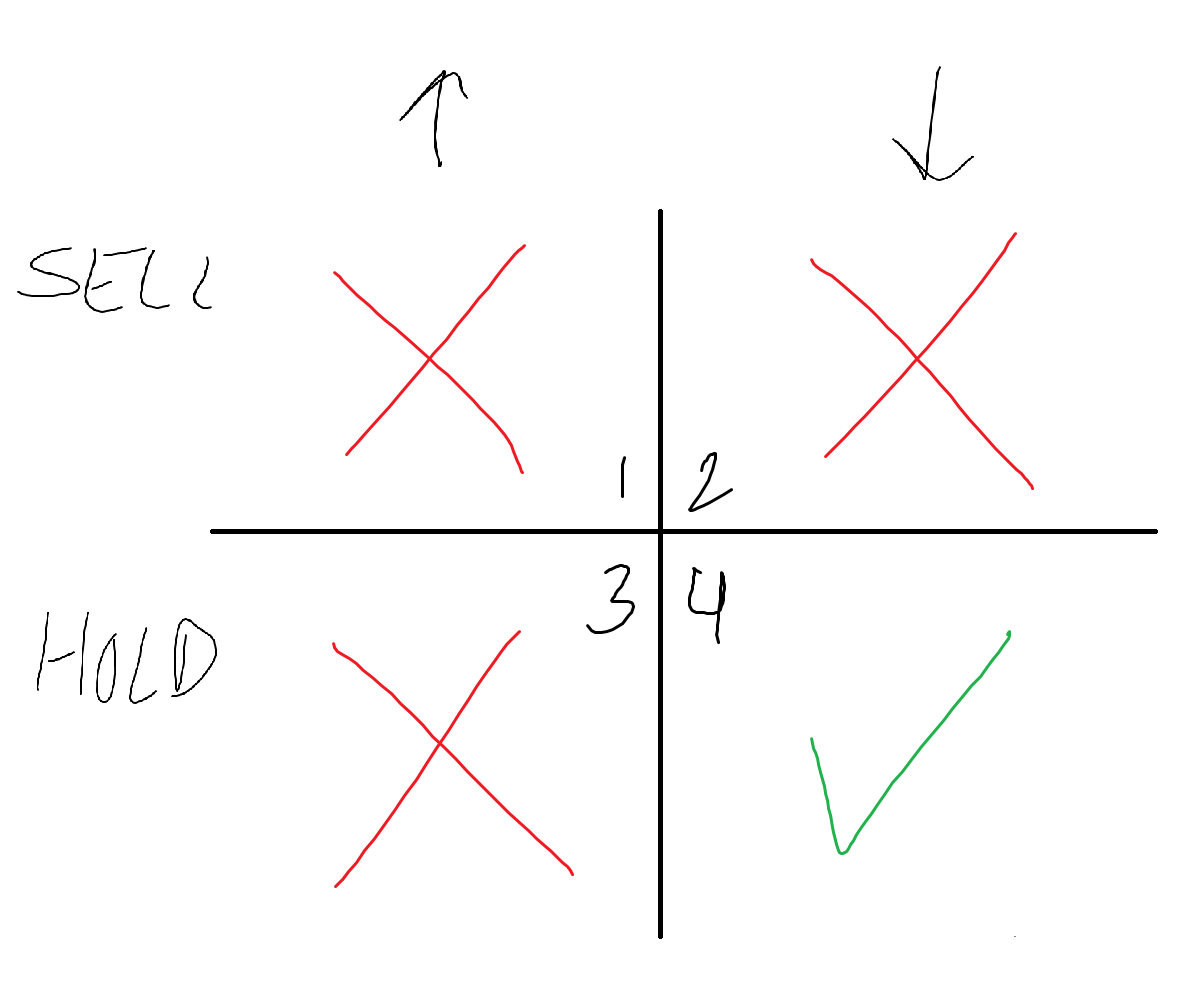

This simple-yet-effective framework, which is applicable in all types of decision-making, is especially useful within investing (a field known for its binary outcomes). Based on two criteria — the x and y axes — it manifests itself as a box with four quadrants, each representing a discrete scenario that can be imagined and analyzed.

By concretely mapping out potential outcomes a priori, it helps transport the decision-maker/investor into a future state of mind, where they can ask the key question: “How do I feel in each scenario?” Believe it or not, investing (and, by extension, personal finance) is more about behavior than spreadsheets, so The Matrix focuses on future emotional state rather than future economic state. It’s essentially a form of psychological time travel.

To help illustrate, let’s review two examples:

Example #1

Your brother-in-law has been chirping at you for years about blockchain and cryptocurrencies and de-fi and blah blah blah. Even worse, he shows up every Christmas sporting a more expensive car and whiter teeth. Then this year, you find out he flew into town… on a private jet. Enough is enough; you have to see what all the hype is about. After several weeks of envy-induced research, you find the next hot memecoin. Should you buy it? Let’s look at The Matrix to help us decide:

Scenarios 1 and 4 obviously make you happy — in one, you buy the coin and the price goes up; in the other, you don’t buy it and the price goes down. These can be disregarded. But let’s dive into scenario 2 (you buy and the price tanks) and scenario 3 (you don’t buy and the price skyrockets). Which feels worse, losing all your money or missing out on the next Ethereum? Watching your BIL literally fly off into the sunset or telling your wife no vacations this year? If scenario 3 feels worse than scenario 2, you might want to dive in. If it’s the opposite, you should probably sit this one out.

In this case, you realize you don’t have the stomach for a volatile cryptocurrency that could wipe out your entire account. Scenario 2 is untenable; your decision is made. You log out of reddit and get back to your regularly-scheduled life.

Example #2

You work at a big, famous tech company that hands out RSUs like candy. Five years in and you’re sitting on a pile of stock whose value has quadrupled. You like your job and things seem to be going well, but you don’t love the idea of having so much exposure to one industry, one company, one product. So you ask the obvious question: “Should I sell?” It’s time to consult The Matrix:

For simplicity’s sake, let’s just assume you’re either selling all the stock or none of it. Here, scenarios 2 and 3 aren’t worth much consideration — again, you’re happy in both — so let’s analyze scenario 1 (you sell then price takes off) and scenario 4 (you don’t sell and the price drops). You imagine each situation and ask yourself which is least desirable. If you’re totally fine with leaving some money on the table, but would be devastated if your stock declined in value, then maybe it’s time to sell. But if you’d hate to see your colleagues get rich(er) and wouldn’t mind a potential dip in net worth, then holding could be the better option.

After analyzing the scenarios, you decide to not sell: you don’t have a huge need for cash right now, you believe in the company’s prospects, and you’re young enough to recover from any losses. Future-you will be OK.

Takeaway

These are overly simplistic examples, but they show that The Matrix can be very helpful when considering whether to buy, sell, or hold. Just remember that it all depends on your unique situation: your age, income, assets, goals, dreams, and — most importantly — your personality. Armed with just a basic level of self-awareness, this exercise can turn the abstract into the tangible and lead to better investment decisions.

🤙🏼 Pura vida,

Sent with 💛 from Pittsburgh

Thanks for reading!

If you enjoyed this post, please click the 🤍 below. It’ll help spread the word.

Disclaimer: Nothing in this newsletter should ever be considered investment advice.

I actually was thinking of reaching out for advice again. In the meantime someone reached out to me for (non-financial) advice. I will have them consider this foursquare grid and envision their wobbly drawn face occupying various future emotional states until they reach green check mark status. This is simple and great, thanks!